|

The Minnesota Credit Union Network is starting the new year with a full line up of virtual Peer-to-Peer (P2P) sessions. Last year, the Network provided 19 P2P roundtables, bringing together 425 attendees representing 57 different credit unions. Attendees participated in sessions with expert panels and presenters, facilitated conversation and group discussion.

As we look forward to the new year, P2Ps will continue virtually to provide programming and networking opportunities, with an increased focus on creating forums that foster credit union collaboration. We are excited to be launching a new event platform which will assist in providing an enhanced virtual experience. Below is our list of scheduled P2Ps for the spring of 2021. Spring 2021 P2P Sessions: 03/09 Financial Education P2P 03/10 BSA Officer and Compliance P2P 03/18 Branch Operations P2P 03/25 Accounting & Finance P2P 04/08 Collections P2P 04/14 Training & Development P2P 04/22 Data & Analytics P2P 04/28 Innovation P2P 05/06 Call Center P2P 05/11 Commercial Services & Lending P2P Announcements coming soon for:

Here are a few things our participants have said about the sessions: “I like that there was some time for open discussion between everyone. It's nice to hear how each place approaches different things. Brings to light things we may not have thought of.” “Having these virtual sessions allows more people to participate without regard to location.” “I enjoyed hearing what other CUs are doing and how they are operating through their challenges, as well as the open discussion, to be able to hear input or suggestions from other CUs.” “Speakers had interesting topics and engaged the participants for feedback.” With questions, please reach out to Ben Hering, Director of Engagement. The CUNA Executive Committee has recommended the appointment of the following individuals to serve on committees and represent Minnesota credit unions.

The Network thanks Chuck Albrecht, Mid Minnesota Credit Union for his service as an outgoing member of the Advocacy Committee. Dave Boden, Hiway Credit Union will continue to serve as CULAC Trustee. Additionally, Christine Cordell, Hiway Credit Union, has been elected to the National Foundation Board. Congratulations to everyone! The Minnesota Credit Union Network is looking for interested candidates to serve as their credit union’s Grassroots Coordinator Program. MnCUN hosts events each year to train and educate Coordinators to continue to grow as advocates for the entire credit union industry.

With a new Presidential administration and new members of Congress and state legislators, political advocacy is critical to advancing the credit union movement. For more information about the program, please contact MnCUN Director of Government Affairs, Ryan Smith at rsmith@mncun.org. Register now for Credit Union Impact Week – the virtual version of our annual Credit Union at the Capitol Day. The week will offer multiple opportunities to engage with legislators and promote the CU Difference.

Last week, MnCUN provided a preview of the 2021 MN Legislative Session and a preview of the CU Impact Week at the Capitol. A recording of the webinar is available for viewing (log in required). MnCUN staff briefed attendees on the credit union-specific issues we’ll be talking with legislators about and provide a complete rundown of what to expect for CU Impact week at the Capitol. The 2021 CUNA Governmental Affairs Conference (GAC) is March 2 to March 4 and will be taking place virtually due to COVID-19. There are two unique opportunities for participation this year. Crash the GAC will take place between March 1 and March 5.

Option 1: The Cooperative Trust and Credit Union National Association are joining forces to offer 50 scholarships for Crashers at GAC in 2021. Only 50 Crashers will receive FREE conference registration from Credit Union National Association. Option 2: The Crasher’s credit union covers their registration fee and emerging leaders can simply register to participate in this year's Crash the GAC experience. Vist CUNA's website for GAC conference fees. That's right, credit unions can pay their Crasher’s registration fee so that they may attend the GAC in 2021. Crashers choosing this option will need to upload proof of registration in the application. This is the premier credit union advocacy event of the year; Crasher spots are limited and coveted. We're looking for the brightest talent and those who are passionate about serving others through cooperative finance. Applications accepted through 11:59pm CT on Sunday, January 31. Education Credit Union Council & National Youth Involvement Board Collaboration Webinar, Jan . 271/19/2021

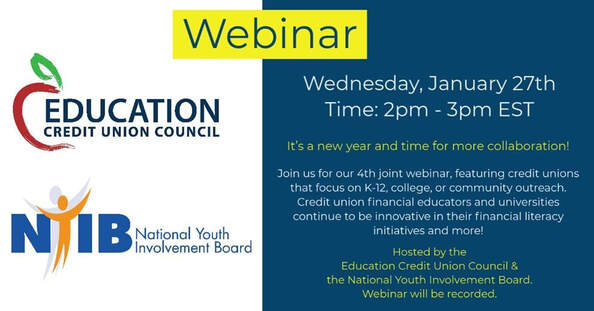

It’s a new year and time for more collaboration! Join NYIB for a joint webinar, featuring credit unions that focus on K-12, college, or community outreach. Credit union financial educators and universities continue to be innovative in their financial literacy initiatives and more!

The webinar is hosted by the Education Credit Union Council and the National Youth Involvement Board and will take place on January 27, 2021 at 2pm EST. For information, contact Tina Jones, Community Outreach Administrator at Hiway Credit Union and NYIB Treasurer.

First Alliance Credit Union surprised member Heather S. of Dodge Center with a $5,000 check and Financial One Credit Union will celebrate their winner this Friday at their Columbia Heights location.

As of December 2020, WINcentive in Minnesota has reached 8,400 accounts open with nearly $10 million in total saved by members of credit unions throughout the state. WINcentive Savings incentivizes consumers in to save by offering risk-free rewards. WINcentive prizes are awarded on a monthly, quarterly, and annual basis, with prizes ranging from $100 to $5,000. Account holders in Minnesota qualify for up to four chances per month for each $25 increase in their month over month savings balance. The Minnesota Credit Union Network and TruLync also administer prize-linked savings programs for credit unions in Delaware, Georgia, Hawaii, Louisiana, Massachusetts, Montana, New York, New Jersey, Ohio and Wisconsin. To date, the programs provide nearly 29,000 members the opportunity to win through prize-linked savings accounts, with over $40 million saved. In total, the programs have awarded over $1 million dollars to members of credit unions throughout the nation. For details about prize-linked savings, please contact Director of Engagement, Ben Hering, via email. More information about WINcentive Savings, including a list of participating credit unions, can be found at wincentivesavings.org. Last week, Minnesota Credit Union Network staff presented legislative and regulatory priorities, events and initiatives, and updates credit unions can look forward to in 2021. The presentation is available to view in the Member Portal.

It’s important to us that you make the most of your membership with the Network and CUNA. Here are some ideas to further engage your credit union and maximize your membership - including professional development and training, strategic products, compliance, and news updates. Support a favorable legislative environment

Ease your regulatory & compliance worries

Stay informed about industry updates and MnCUN opportunities

Increase awareness in the market place about credit unions

Provide robust product & service offerings to your members through MnCUN strategic partnerships

Engage in professional development and networking opportunities Major events:

For additional opportunities, visit the Get Involved page. As your state trade association, the Minnesota Credit Union Network works proactively to create the environment for credit unions to grow market share and demonstrate the CU Difference. To help achieve this goal, MnCUN has stablished restricted funds to strengthen our advocacy efforts on behalf of Minnesota’s credit unions.

Advocacy Fund This fund provides resources to strongly position credit unions on the legislative and political fronts. The Advocacy Fund is proactive in nature, helping to create a strong credit union environment and augment MnCUN’s advocacy efforts. As a restricted fund, expenditures are governed by a committee of credit unions and MnCUN staff. Minnesota Credit Union Foundation Focused on financial education and professional development initiatives, the Minnesota Credit Union Foundation is dedicated to providing the resources for credit unions and communities to prosper and thrive. Each year the Foundation commits to fund financial education grants and professional development opportunities for credit union staff and volunteers. Awareness Fund The Credit Union Awareness Fund was established to focus on increasing consumers’ awareness of credit unions through public affairs initiatives, expanding media coverage, and coordinating other visibility opportunities. Expenditures from this fund promote the benefits and value of credit unions, helping to spread the word that credit unions are the best financial choice for consumers. As a restricted fund, expenditures are governed in accordance to the Board’s strategic plan, by the Awareness Fund Committee of credit unions and MnCUN staff. View the 2020 Special Funds Report for details on activities supported by these funds. Please consider supporting these funds and initiatives that help position credit unions as the best financial partner for Minnesotans and fulfill the “people helping people” philosophy. |

The PulseThe Pulse is MnCUN's newsletter that keeps credit union professionals and board members updated on current news and information. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed