|

Raising money for federal and state political action committees is critical for credit unions this election year. Dollars contributed to CULAC (CUNA’s PAC for federal candidates) and CUPAC (MnCUN’s PAC for state candidates) ensure that we continue to have credit union champions in all levels of elected office. To help credit unions remain strongly positioned politically, the Network has created a number of fundraising programs, including the Fair Share Program.

The Fair Share is a dollar amount per employee for credit unions to strive towards raising to support both PAC’s. The Network’s Political Involvement Committee last year set the Fair Share target at $30 per credit union employee per year. The below credit unions achieved their Fair Share goal for 2021:

The Network would like to express its gratitude for the fundraising efforts of all of our credit unions. We would also encourage all of our members to make a plan to try to hit their Fair Share goal for 2022. For any questions, please contact MnCUN’s Director of Government Affairs, Ryan Smith. The mission of the Women’s Leadership Network (WLN) is to inspire, empower, and advance Minnesota credit union women by creating a community of belonging, and providing tools for personal and professional development, and to help women influence their legacy. The Minnesota Credit Union Women’s Leadership Network is a sister society of the World Council of Credit Unions’ Global Women’s Leadership Network.

The following accomplishments were achieved in 2021:

Watch for details on 2022 events and registration information coming soon. Those interested in receiving notifications about future events and opportunities may sign up for Women’s Leadership Network communications. Instructions are available online at https://www.mncun.org/womens-leadership-network.html. The Minnesota Credit Union Employee Benefits Plan (Plan) has expanded participant eligibility to employees of Credit Union Services Organizations (CUSO). The Plan is an association health plan through which participating employer groups purchase health benefits for their employee as if they were one larger group.

Through this collaboration, Minnesota headquartered credit unions -- and now CUSOs -- obtain more bargaining power and reduce risk and cost volatility in purchasing health benefits for employees. Late in 2021, the board of trustees for the Plan approved amendments to the bylaws to allow CUSOs, headquartered in Minnesota and owned in whole or in part by a MnCUN member credit union, to participate in the Plan. This expansion provides more opportunities for the Plan to grow and at the same time provides an excellent option for eligible CUSOs. Please visit the Plan’s webpage for more information or contact Tim Tacheny or Tommy Rempfer.

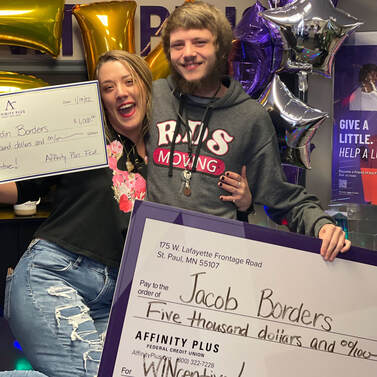

Jordin helped Affinity Plus branch staff to surprise her brother with the grand prize check and was beside herself when she found out she also won $1000.

“You don’t understand where we come from, this is life changing," Jordin told Affinity Plus branch staff. Participating members of all 21 Minnesota-based credit unions offering WINcentive were eligible for the monthly, quarterly and annual statewide prizes for 2021. Each credit union is also guaranteed to have one $100 winner each quarter. As of December 2021, nearly 8,500 members of credit unions in Minnesota have saved $12 million in WINcentive savings accounts throughout the state. WINcentive Savings incentivizes consumers in to save by offering risk-free rewards. WINcentive prizes are awarded on a monthly, quarterly, and annual basis, with prizes ranging from $100 to $5,000. Account holders in Minnesota qualify for up to four chances per month for each $25 increase in their month over month savings balance. The Minnesota Credit Union Network and TruLync also administer prize-linked savings programs for credit unions in Delaware, Georgia, Hawaii, Louisiana, Massachusetts, Montana, New York, New Jersey, Ohio and Wisconsin. To date, the programs provide over 33,000 members throughout the nation the chance to win through prize-linked savings accounts, with nearly $70 million saved. Prize-linked savings facilitated by TruLync have awarded over $1 million dollars to members of credit unions since its inception. More information about WINcentive Savings can be found at wincentivesavings.org. Created in 2008, the Credit Union Builder Award honors an individual’s dedication to the success, growth, and vitality of the not-for-profit financial movement in Minnesota.

Dedications are typically made at a special time of significance to acknowledge their contributions to credit unions. In total, 79 individuals have been designated as Credit Union Builders over the past fourtneen years. The name of the recipients are permanently displayed in lobby of the state trade association, the Minnesota Credit Union Network, as a tribute to those who have dedicated time and energy to building the credit union movement. The honorees (or their families, in the case of a memoriam contribution) receive acknowledgement from the Minnesota Credit Union Foundation, and donors are also listed online and in the Foundation’s annual report. A minimum $1,500 contribution is required to designate a Credit Union Builder Award. With questions, contact Andrea Molnau, Executive Director of the Minnesota Credit Unions Foundation. An investment in the Network is an investment in your credit union – to create a positive legislative environment, to ease your regulatory burden, and to increase market awareness so your credit union can thrive. Membership means your never stand alone. We have ideas to further engage your credit union and maximize your membership - including professional development and training, strategic products, compliance, and news updates. Support a favorable legislative environment:

Ease your regulatory & compliance concerns

Stay informed about industry updates and MnCUN opportunities

Provide robust product & service offerings to your members through MnCUN strategic partnerships Engage in professional development and networking opportunities

With questions about your membership or any of the opportunities noted above, please contact Mark Cummins or Andrea Molnau. The Minnesota Credit Union Network is now accepting nominations for its most prestigious awards. Now is your chance to nominate a colleague for the 2022 Outstanding Professional of the Year or Outstanding Director (formerly Volunteer) of the Year.

The winners of these awards will be recognized during the Minnesota Credit Union Network's annual conference - the ACCELERATE 22 Conference, which will take place April 21 & 22 at the Radisson Blu Mall of America in Bloomington.

Nominations for the awards must be received by the Network by Friday, Feb., 18 by 5 p.m. Complete information and online nomination forms can be found on the MnCUN website. Please note that only nominations completed using the online forms will be accepted. Contact Julia Miller, MnCUN Director of Communications with questions. The Minnesota Credit Union Network Election Committee, appointed by Mary Hansen, Chair of the Minnesota Credit Union Network, has the responsibility of overseeing the 2022 Network Board of Directors election process.

The election will be conducted exclusively by mail ballot. Three (3) seats are up for election in 2022: one in the at-large category (3-year term), and two in the 10,000 or fewer credit union members category (3-year terms). The current Board of Directors is comprised of the following individuals (an asterisk indicates that the seat is up for election): Dave Boden: At-Large* Mary Hansen: At-Large Brian Sherrick: At-Large Tom Smith: At-Large Dan Stoltz: At-Large Karen Fleming: Fewer than 10,000 members* Julia Havens: Fewer than 10,000 members Debora Almirall [1]: Fewer than 10,000 members* Randy Willert: Fewer than 10,000 members The election process is outlined in the Network bylaws, Network Election Policy and 2022 Election Rules, and was initiated with the appointment of the Election Committee. The components and time frames are as follows:

The election results will be announced at the Network’s annual business meeting on April 21, 2022. The 2022 Candidacy Declaration form and the 2022 Board Election Rules are located on 2022 Board Elections webpage. If you have any questions, please feel free to contact any member of the Election Committee. The members of the committee are set forth below. Brian Sherrick, Chair Ideal Credit Union Phone: (651) 747-8903 bsherrick@idealcu.com Randy Willert Two Harbors Federal Credit Union Phone: (218) 834-2266 rwillert@thfcu.org Kim Westphal HomeTown Federal Credit Union Phone: (507) 451-3798 kwestphal@hometowncu.com On January 6, the Minnesota Credit Union Network submitted comments on the Consumer Financial Protection Bureau’s (Bureau) proposed rule on Small Business Lending Data Collection under the Equal Credit Opportunity Act (Regulation B). The comments were based upon input received from the Regulatory Review Committee and CUNA.

|

The PulseThe Pulse is MnCUN's newsletter that keeps credit union professionals and board members updated on current news and information. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed