|

The Minnesota Credit Union Network again worked with Fluence Media and American Strategies in January 2022 to conduct our biennial public opinion poll. The poll is designed to better understand Minnesota consumers’ perceptions of financial institutions and gauge their attitudes and knowledge of credit unions. The study tested attitudinal trends, public affairs opinions, and several aspects of the consumer awareness and consideration efforts.

Please join us for a webinar to hear key findings and look at the results, trends, and perceptions Minnesotans have about credit unions on Wednesday, April 6 at 2:00 pm. The webinar if free but we ask that you please register. The Minnesota Credit Union Network Election Committee, appointed by Mary Hansen, Chair of the Minnesota Credit Union Network, has the responsibility of overseeing the 2022 Network Board of Directors election process.

In accordance with the Bylaws of the Minnesota Credit Union Network, since only one person was nominated for each seat to be filled, no ballots were distributed, and candidates are each elected by general consent or acclamation. Congratulations to Dave Boden, Hiway Credit Union, and Debora Almirall, Minnesota Power Employees Credit Union for being re-elected and Dana Garrett, North Memorial Federal Credit Union, for being elected to serve on the Network’s Board of Directors. Dana Garrett had served as Chair of the Minnesota Credit Union Foundation, and with her election to the Network Board of Directors, stepped down from the Foundation Board. Subsequently, the Foundation elected new table officers, and will fill Dana’s seat at their Annual Meeting in July. Congratulations to Chair Doug Hallstrom, Minnco Credit Union, Vice-Chair Doug Ralston, Centricity Credit Union, and Secretary/Treasurer Kim Westphal, HomeTown Credit Union. Association for Black Economic Power Provides Project Update for Village Financial Credit Union3/23/2022

In recognition of the support from the Minnesota Credit Union Community to launch Village Financial Credit Union, the Association for Black Economic Power (ABEP) is pleased to provide the following update on the status of the charter applications process. ABEP is a nonprofit organization created to establish a Black-led credit union to address systemic financial challenges impacting Minneapolis residents, particularly people of color.

Project updates include:

The Minnesota Credit Union Foundation is seeking both Capital Contributions and Pledges of Deposit to help support this effort. To have your contribution be included with the Charter Application, please make your commitment by April 8, 2022. To learn more, visit mncun.org/villagefinancial or contact Minnesota Credit Union Foundation President Mark Cummins or Executive Director Andrea Molnau. A monthly call has been scheduled through MnCUN to provide additional updates and the opportunity to ask questions. Those interested in participating can reach out to Samantha Marks for the log in credentials.

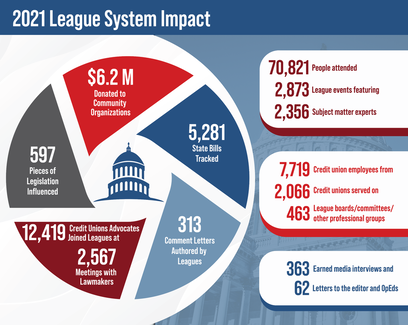

“We are proud to be a part the League System,” shared Mark Cummins, President and CEO of MnCUN. “We value our members continued trust in us and are only able to accomplish our goals with the partnership and engagement of our member credit unions.”

Highlights of the report include:

This Friday, March 25, is the first legislative deadline for the Minnesota legislature.

For the first Data & Analytics P2P of the year, Ellen Boyd, Business Intelligence & Reporting Manager with Ideal Credit Union, will join us to discuss several data-focused projects their credit union is working on including member outreach, their rewards program, branch budgeting, and more.

We will continue with an open format conversation with credit union peers around data hot topics, including data governance and data strategy and will include credit union case studies. This event is meant to be an opportunity to meet and share with one another. Date: Tuesday, March 29 Time: 1:00 p.m. This event will be made only via webinar/conference call. Webinar and call in instructions, along with recordings, session materials and resources, will be provided to registered attendees. For a list of all P2P sessions, visit our Peer-to-Peer (P2P) webpage. With questions, please contact MnCUN Director of Engagement Ben Hering by email or by phone at 651-288-5519.  Doug Differt Doug Differt The Minnesota Credit Union Foundation (MnCUF) and Hiway Credit Union are proud to recognize Doug Differt as a CU Builder for his service to the credit union movement upon his retirement from the Hiway Credit Union Board of Directors. Doug Differt has served as Board Chair, Vice Chair and Secretary and on all Board Committees during his 42 year tenure, bringing much insight and value to Hiway. Doug will continue to share his knowledge with the Board as an Emeritus Director. He is the driving force behind the "Douglas Differt Difference Makers (D3M) Endowed Scholarship," which was established to inspire and empower future students interested in careers in Science, Technology, Engineering and Mathematics (STEM), specifically transportation and construction. D3M has raised over $500K to help finance the education of students at Inver Hills Community College and Dakota County Technical College—students who will go on to become project leaders, troubleshooters and innovators in STEM fields. Created in 2008, the Credit Union Builder Award honors an individual’s dedication to the success, growth, and vitality of the not-for-profit financial movement in Minnesota. Dedications are typically made at a time of significance to acknowledge an individual’s contributions to credit unions. 80 individuals have been designated as Credit Union Builders since the award's inception. The names of the recipients and the contributing credit unions are permanently displayed in the Minnesota Credit Union Network’s lobby as a tribute to those who have dedicated time and energy to building the credit union movement. Contact Andrea Molnau, Executive Director of the MnCUF with questions.  The ATM Fees campaign is an opportunity to market the philanthropy that credit unions are doing to non-members. By placing a sticker on the ATM unit showcasing the small donation amount has resulted in positive feedback from the non-members making withdraws. To learn more about what some credit unions enjoy about this campaign, check out the case study. How to execute the campaign:

|

The PulseThe Pulse is MnCUN's newsletter that keeps credit union professionals and board members updated on current news and information. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed