|

The Minnesota Credit Union Network’s mission is to serve credit unions by supporting growth in market share through advocacy, awareness, leadership, regulatory relief, professional development and strategic partnerships. As we look back on 2020, your feedback and input guide the service extended back to you as your state trade association.

Please provide to the Network staff and Board of Directors your response to our 2020 annual performance via the survey link below by Wednesday, March 31. 2020 Minnesota Credit Union Network Performance Survey This survey will take 5-10 minutes of your time and we welcome all comments. Please contact MnCUN Director of Engagement, Ben Hering, with questions via email. Thank you, in advance, for your contribution to helping us make the Network an organization able to meet the needs of credit unions in and around Minnesota. The NCUA Board announced at their board meeting last week a distribution from the Corporate Resolution for several corporates, including Members United.

MnCUF Financial Education Grants support credit unions’ implementation of financial education projects in their credit union and communities. The application period is open so that credit unions may apply for funding at any time throughout the year.

MidMinnesota Federal Credit Union recently received a grant for their financial education videos series in partnership with Bridges, a local community resource for schools. As in person classroom presentations ceased with the pandemic, MMFCU and Bridges partnered to film short Financial Education videos for teachers to embed in their online learning or show in class. SouthPoint Financial Credit Union also recently received a grant to work with local schools in their branch areas to provide the interactive immersive experience Mad City Money reality fair. Financial Education Grant Applications are evaluated by the Minnesota Credit Union Foundation Board of Directors and funding is based on factors such as credit union value, community impact, collaboration, and creativity. Financial education initiatives may include projects in the following areas:

For more information and to apply, visit mncun.org/apply-for-a-grant. Last Friday was the second committee deadline at the Minnesota legislature, where committees must act favorably on bills, or companions of bills, that met the first deadline in the other legislative body.

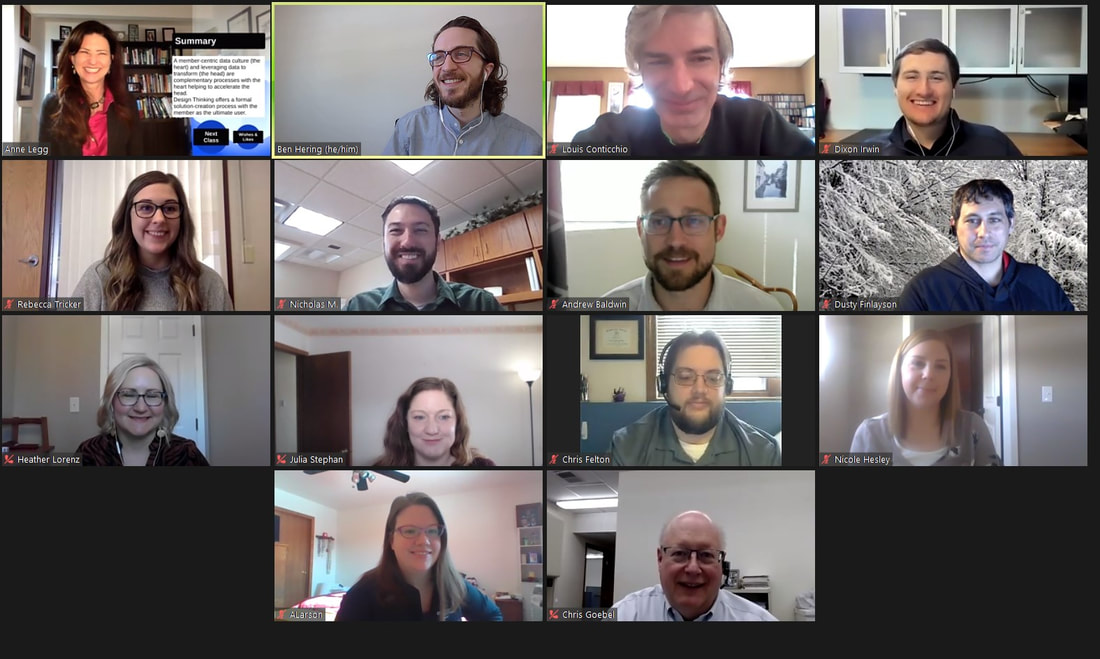

In February, twelve staff from Minnesota Credit Union Network-affiliated credit unions became Certified Data Transformation Specialists as a part of a newly launched MnCUN Data Education Program. The newly certified staff represent eleven credit unions across the state.

Facilitated by Anne Legg, Founder & CEO of Thrive Strategic Services, the new data analytics education series offered tools and a forum for knowledge exchange for stakeholders to fill knowledge gaps and launch or continue their data journey with the assets they have at their credit union. Topics and assignments included a current data assessment, enterprise data vision, member-centric use cases, building data maturity and adopting a data culture within credit unions. Participants were asked to complete a data analytics roadmap to complete the certification. Congratulations to the following credit union staff: Heather Lorenz, Business Analyst | Affinity Plus Federal Credit Union Nicole Hesley, Digital Marketing Coordinator | Anoka Hennepin Credit Union April Larson, Data & Research Analyst | Centricity Credit Union Rebecca Tricker, Marketing Assistant | City & County Credit Union Dustin Finlayson, Data Analyst | Members Cooperative Credit Union Christopher Goebel, Vice President, Finance | Minnco Credit Union Nicholas Mathiowetz, President/CEO | NorthRidge Community Credit Union Louis Conticchio, Data Solutions Analyst | Novation Credit Union Dixon Irwin, Data Specialist | Red Wing Credit Union Andrew Baldwin, Business Intelligence Analyst | Royal Credit Union Julia Stephan, Digital Analyst | Royal Credit Union Chris Felton, Data Systems & Reporting Analyst | SouthPoint Financial Credit Union With questions, please contact Director of Engagement, Ben Hering, via email. The Minnesota Credit Union Network Annual Business Meeting will be held remotely on Friday, April 23, at 1:00 pm. The meeting will feature an overview of credit union accomplishments over the past year and the Board election results.

We ask that all voter representatives and other attendees from the credit union register by April 16. Pursuant to the Bylaws of the Minnesota Credit Union Network and the Meeting Rules of order, only authorized voter representatives shall be entitled to the privilege of the floor and allowed to vote at the Meeting. You may register online for the event. With questions, please reach out to Mara Humphrey, Chief Advocacy & Engagement Officer by email or phone 651-288-5523. We are hopeful to be in person at the Annual Convention November 18-19, 2021 at the Radisson Blu Mall of America. The Network had a very successful week at the Minnesota legislature last week with some notable victories on key credit union issues.

As part of the activities built around CUNA’s Governmental Affairs Conference (GAC), MnCUN wrapped a successful week of fundraising for CUNA’s political action committee, CULAC.

MnCUN members contributed nearly $25,000, second only to California for the highest fundraising total of all other states. The high total also ensures that MnCUN prevails in an interstate competition we had undertaken with the Wisconsin Credit union League, raising nearly three times as much money as our friendly neighbor rivals. “Our fundraising success during the GAC is only possible because of our amazing members that contribute because they understand the importance of supporting credit union champions running for Congress,” said MnCUN Chief Advocacy and Engagement Officer Mara Humphrey. “On behalf of everyone at MnCUN and CUNA, I want to thank everyone that is willing to contribute to our fundraising efforts.” Updated BSA/AML Training Webinar Available

ViClarity 2021 Bank Secrecy Act (BSA) & OFAC Annual Staff Training is now available to MnCUN member credit unions. Stimulus Payments Round Three The IRS has begun sending out economic impact payments (EIP) issued pursuant to the American Rescue Plan Act of 2021 (the “Act”). Class Action Lawsuits over Foreign Transaction Fees One of the recent litigation trends posing a risk for credit unions are lawsuits involving the assessment of foreign transaction fees. |

The PulseThe Pulse is MnCUN's newsletter that keeps credit union professionals and board members updated on current news and information. Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed