|

Join us September 10-12 at Maddens on Gull Lake, Brainerd for LEAD 21 - the Minnesota Credit Union Network’s rebranded Fall Leadership Conference. This in-person event will feature industry experts providing insight and relevant information on top credit union issues. We are pleased to highlight our Friday afternoon breakout session speakers:

Director Track: Understanding Your Credit Union’s Economic Engine Most of us believe we know the most important key financial measurements on which to focus because we have been conditioned to think this way. Unfortunately, most of us are paying attention to the wrong metrics and ignoring more important ones. In this session, Jim Kasch, Founder, Canidae Consulting, will expose the credit union’s economic engine and will focus on multiple measurements – some of which are not reported routinely to the Board or regulator – that best indicate future success. This entertaining and thoughtful session may challenge the way you think about your credit union’s performance, and may help you redefine what a successful credit union looks like. Executive Track: Part of the Solution: how credit unions can help further economic development in Minnesota, Dr. Bruce Corrie, PHD, Associate Vice President for Government & Community Relations and Professor of Economics at Concordia St. Paul has over two decades of experience working with the financial industry - from the SBA to the Federal Reserve Bank of Minneapolis. In this session, Dr. Corrie will share insights on the current state of racial disparities in Minnesota and how credit unions can play a role in the economic development solutions – including lending to minority businesses and strategies to build wealth in the ALANA (African Latino Asian and Native American) communities. With educational sessions and recreation opportunities, this event provides an opportunity to come together with your credit union colleagues for a weekend of learning, networking, and fun. The room block deadline is August 10; and conference registration ends August 20. More information, schedules, lodging information and registration links are available online at mncun.org/lead-21-conference. The Minnesota Credit Union Network works to ensure the success, growth and vitality of our member credit unions. To help achieve this goal, MnCUN has established restricted funds to strengthen our efforts on behalf of Minnesota’s credit unions – the Advocacy Fund and the Awareness Fund.

The Credit Union Advocacy Fund provides resources to strongly position credit unions on the legislative and political fronts. The Advocacy Fund is proactive in nature, helping to create a strong credit union environment and augment MnCUN’s advocacy efforts. Expenditures from the Advocacy Fund are used to enhance MnCUN’s dues supported advocacy activities and increase credit unions’ impact through:

The Credit Union Awareness Fund is focused on increasing consumer awareness of credit unions, including but not limited to, commissioning research, working to expand media coverage, and coordinating other visibility opportunities. Expenditures from this fund promote the benefits and value of credit unions, helping to spread the word that credit unions are the best financial choice for consumers. The biennial consumer research study that was planned for January 2021 was conducted in August of 2020 to gauge consumer attitudes about credit unions while in the midst of the pandemic. Results showed familiarity with credit unions has increased 11 points from 2013 to 2020. Minnesota’s 2020 Awareness Initiative made strides in boosting consumer awareness of credit unions. 122,000,000 impressions were delivered in through OTT Streaming Ads, Social Media, Banner and Video Pre-roll, and statewide radio and transit ads. The year-end Google Poll conducted in December noted 34% of respondents in our target demographic recalled seeing our ads, and 50% indicated they are likely or very likely to join a credit union. In the first half of 2021, fresh creative was launched on Digital + Streaming ads and out of home efforts are being planned for the second half of the year. In addition, number of enhancements and new features to the national Your Money Further website were introduced. Along with the consumer awareness initiative, the Awareness Fund supports additional Public Affairs activities on behalf of Minnesota’s Credit Unions:

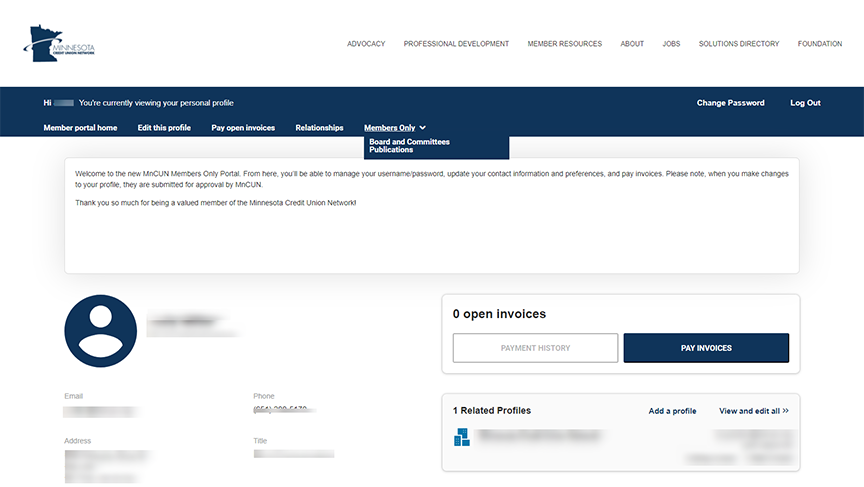

As restricted funds, expenditures from the Advocacy and Awareness fund are governed by their respective committees of credit unions, with input from MnCUN staff and consultants. Solicitation for these funds occurs each year in conjunction with the issuance of the Network’s annual membership dues invoice, as well as on an as-needed basis. The Minnesota Credit Union Network would like to thank credit unions for their support of the Awareness and Advocacy Funds. Full report details and financial statements have been mailed to member credit unions. As part of our efforts to improve the user experience on mncun.org, we are pleased to introduce a new feature that will make it easier to utilize the self-service options of the member portal. On Friday, July 30, the interface you see when you log into mncun.org will change. No action is necessary but you are encouraged to take advantage of the upgraded ability to manage your preferences and access members only benefits:

The idea may be big, but making it happen is simple for you! Visit the resource hub to access everything you’ll need to plan for and engage members in this exciting, nationwide collaboration. You’re welcome to personalize these materials with your own branding, design your own content, and add those unique touches that will speak to your membership.

The Illinois Credit Union League (ICUL) is spearheading this effort and you can read more about the effort: A positive message worth going viral! - CUInsight NCUA’s NOL Policy Should Look Beyond the Numbers: In May, the National Credit Union Administration (NCUA) issued a request for comment on the policy for setting the National Credit Union Share Insurance Fund’s normal operating level (NOL).

NCUA Issues Proposed Rule on RBC and Request for Information on Digital Assets: At its meeting last week, the National Credit Union Administration (NCUA) Board issued a proposed rule and a request for comment. The MnCU Foundation is proud to offer a CUDE Scholarship this year. This scholarship was created to provide financial assistance to credit union staff and/or volunteers who are members of the Minnesota Credit Union Network (MnCUN) and wish to attend the National Credit Union Foundation’s Credit Union Development Educator Training. Preference will be given to applicants that have shown engagement with the credit union movement.

Application Deadline: July 30, 2021 Scholarship recipient will be notified by August 6, 2021 Fall Virtual DE Training Dates: October 18-November 12, 2021 (The MnCUF CUDE scholarship winner will have a spot reserved.) A program of the National Credit Union Foundation, the CUDE program brings renewed relevance to the philosophy of "People Helping People." This unique and transformative training provides critical lessons in cooperative principles, credit union philosophy, and development issues, while incorporating challenges credit unions face today. To apply, visit mncun.org/cudeapp.

While the Credit Unions for Kids and Foundation Scholarship Council’s events were affected by the pandemic, both Foundation Committees were able to fulfill their missions – to provide funding to Gillette Children’s Hospital and hold the annual scholarship program on behalf of Minnesota’s Credit Unions.

The Board Election was held. Doug Ralston of Centricity Credit Union and Glen Durbahn of Hiway Credit Union were both re-elected for 3-year terms. Kim Westphal of HomeTown Credit Union was also elected to her first 3-year term to fill Kathy Harrington’s seat. Kathy Harrington, after serving nine years, has termed off the Foundation Board. She was recognized at the meeting for both her dedicated service and her time as Chair. As a 501(c)(3) tax-exempt charitable organization, the Foundation is dependent on the support of Minnesota credit unions, employees, partners, and community organizations. Visit mncun.org/foundation for a copy of the 2020 Annual Report.

On July 15, the IRS began sending out the advanced child tax credit payments. The payments are being delivered by direct deposit, check and debit card.

|

The PulseThe Pulse is MnCUN's newsletter that keeps credit union professionals and board members updated on current news and information. Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed