|

The Minnesota Credit Union Network is proud to share accomplishments of the past year that we have undertaken on behalf of Minnesota Credit Unions. 2023 was a significant year for MnCUN as Mara Humphrey was appointed to lead the organization as President & CEO.

Dynamic, Bold Advocacy

Inclusive Collaboration

Innovative Solutions to Empower Acceleration

MnCUN staff would like to thank each member for supporting a thriving credit union system in Minnesota. We truly value the important work you do every day for your members, which inspires us to advocate on your behalf to make that job easier. Thank you for your continued support and trust and we look forward to advancing the credit union movement in 2024! Thank you for your partnership in 2023! We look forward to providing dynamic, bold advocacy; inclusive collaboration; and innovative solutions that help accelerate the growth of credit unions in 2024. There will be no Pulse on December 27, 2023 but the newsletter will resume on Jan. 3, 2024. Happy New Year!

Complete Campaign

Digital Advertising

Engagement & Outreach

The over 60 applications were evaluated by volunteer judges:

View the full photo gallery of the awards recipients. Navigating the Competitive Landscape: Insights from the Minnesota Credit Union Network’s Marketing AwardsMinnesota Credit Union Marketing Awards judge LeAnn Case wrote an article from her experience reviewing the diverse strategies employed by credit unions in the state. These summarized excerpts offer a glimpse into the dynamic market and competitive conditions faced by credit unions, showcasing the innovative approaches they take to stand out in a crowded field. The article, shared on the author's LinkedIn page, highlights common themes that emerged from these marketing award entries, providing valuable insights into the ever-evolving landscape of financial services.

CFPB Open Banking Comment Deadline: The CFPB’s proposed rule for open banking calls for consumers to have control over data about their financial lives and would gain new protections against companies misusing their data.

Fraud Warning: Maximus, Inc. Cyber Breach: In May this year, a breach occurred involving the MOVEit file transfer service. BOI Policies for Business Members: FinCEN’s new Business Ownership Interest (BOI) reporting rule effective January 1, 2024, exempts credit unions from direct reporting requirements. Final NCUA Board Meeting of 2023: The NCUA board met for the final time this year on December 14.

In January, the WINcentive Savings program will announce two prizes of $5,000 each as a part of the annual prize drawing. Participating members of all twenty-two Minnesota-based credit unions offering WINcentive will be eligible for the monthly, quarterly and annual statewide prizes for 2024. Stay tuned for special announcements and for the grand prize winner celebrations!

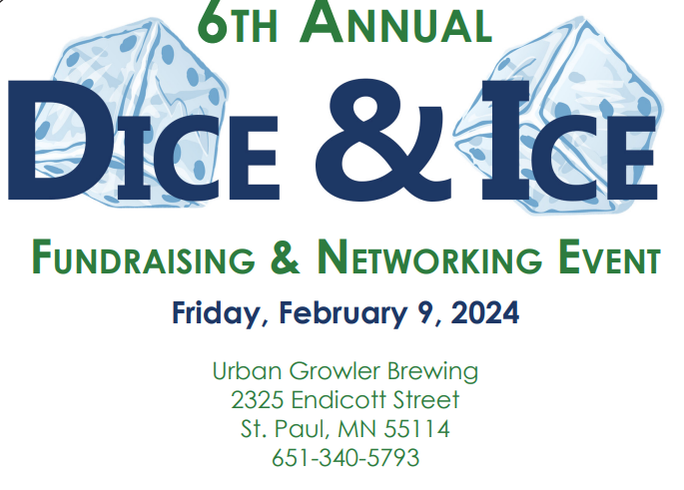

Credit Unions for Kids is a nonprofit collaboration of credit unions, chapters, leagues & business partners from across the country, engaged in fundraising activities that benefit 170 Children’s Miracle Network Hospitals. As our adopted charity of choice, credit unions are the 3rd largest sponsor of CMN Hospitals. Minnesota Credit Union for Kids (MnCU4Kids) supports Gillette Children’s based in St. Paul, with clinics throughout the state. Check out the upcoming events for 2024!

Membership in MnCUN and national trade associations ensures your connection to powerful advocacy, expertise, resources, opportunity, and influence. Dues invoices are being mailed to credit unions this week. View on information on:

We are also humbled by the kind words we have recently received from several members about the value of being a member of the Minnesota Credit Union Network. "Minnco has continually benefited from our membership with the Network - from the Foundation, legal, and compliance services to ongoing advocacy efforts in Minnesota and Washington. Our membership helps Minnco nurture the collaborative benefits with all sizes of credit unions in Minnesota. Most recently, I’ve been very impressed with the new Medicare Advisory service. Dave Brown has demonstrated extensive experience and is a resource I am proud and confident to offer to our members!" - Doug Hallstrom, President/CEO, Minnco Credit Union. "I am engaged with the Minnesota Credit Union Network because of the value it brings to my career and my credit union. The networking events have been a large help in my career by allowing me access to other credit union people that I would not have normally had the opportunity to meet. The peer-to-peer sessions are also a chance to have an in-depth conversation with others in the industry. The information gained from my colleagues helped save my credit union money in a tough year. I wouldn’t be where I am without the help of MnCUN!" -Justin Houle, VP of Finance, Heartland Credit Union MnCUN staff would like to thank each member for supporting a thriving credit union system in Minnesota. We truly value the important work you do every day for your members, which inspires us to advocate on your behalf to make that job easier. Thank you for your continued support and trust! CDFI Application Changes: On December 7, the Department of Treasury’s Community Development Financial Institutions (CDFI) Fund issued a statement regarding its finalized application form for funds specified for advancing communities lacking equal access to opportunities from the financial services industry.

FTC Issues CARS Rule: The Federal Trade Commission (FTC) announced its finalized a new rule to fight two common types of illegal tactics consumers face when buying a car. |

The PulseThe Pulse is MnCUN's newsletter that keeps credit union professionals and board members updated on current news and information. Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed