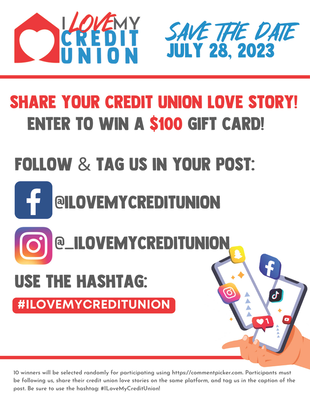

This Friday, July 28, the credit union movement will come together with the purpose of inspiring authentic and high energy conversation about why we love our credit unions. Share your credit union love story and enter to win a $100 gift card!

Use the campaign hashtag, #ilovemycreditunion, across all social platforms to raise awareness about credit unions and share stories about the amazing things credit unions do for their members. NCUA Cyber Incident Reporting Rule: The new rule is scheduled to go into effect on Sept. 1.

FedNow is Here: The Federal Reserve’s FedNow pay rail for instant payments went live on July 20. Big box retailers have recently re-introduced legislation that would change the current credit card interchange system, making our current payments system less secure and hurting consumers. The bill, while purporting to save consumers costs, would dramatically curtail the safety and soundness of the current system, opening credit union members to a greater risk of fraud and expose sensitive data, while not decreasing costs at the register.

This poorly conceived bill has now been introduced as an amendment to a must-pass military funding bill. This bill shouldn’t be anywhere close to legislation funding our military, and these efforts are simply a way to ram this damaging bill forward without even holding a hearing. We need your immediate help to stop any interchange amendment from being added to the National Defense Authorization Act (NDAA). Even if you have reached out on interchange before – this is a separate call to action to keep it out of moving legislation. Visit our Grassroots Advocacy Center to sign up for GREAT and easily send a message to our legislators. GREAT provides credit union supporters a way to help preserve, protect and promote Minnesota credit unions. There is no time or monetary commitment to joining GREAT, and sample email templates are available to quickly and easily send a message to lawmakers. Contact Senators Klobuchar and Smith today and tell them interchange does not belong in the NDAA. Hike the Hill provides credit union representatives with an exciting opportunity to meet with federal legislators and talk about top issues that credit unions in Minnesota are facing. During Hike the Hill visits, credit union professionals and board members will meet with the entire Minnesota Congressional Delegation.

Hike the Hill will take place September 26 -28. Attendees should plan to arrive by early Tuesday afternoon, September 26 and prepared to meet for legislative and regulatory briefings at CUNA’s offices. Meetings with legislators will be scheduled throughout the day on Wednesday, followed by group activities in the evening. Assuming availability of staff and/or Board members, NCUA meetings will take place Thursday morning and attendees can plan to fly out by Thursday afternoon. Please provide the home address for each attendee in the registration for this event. Please contact Ryan Smith at [email protected] with any questions. For lodging information and to register, visit the event page for Hike the Hill. Please join the Minnesota Credit Union Network for a webinar presentation on the personal finance graduation requirement that was recently passed into law.

We'll be joined by Jason Kley, Co-Chair of the Financial Literacy Coalition of Minnesota and we'll highlight the key aspects of the bill and how best credit unions can continue to engage with their local school districts to partner on providing financial well-being. Date: Thursday, August 17, 2023 Time: 10:30 AM - 11:00 AM CST Cost: Free Please contact Andrea Molnau, VP of Communications and Engagement [email protected] or Xiong Lee, Director of Engagement [email protected] with any questions Please join us for a webinar presentation on Minnesota's new Family Medical Leave Act law. This educational webinar will highlight the key aspects of the new law such as eligibility, set offs, and procedures with a focus on how this may affect credit unions as employers.

Presenters: General Counsel Dan Le and Compliance Audit Consultant Becky Frederick. Date: Thursday, August 29, 2023 Time: 2:00 PM - 3:30 PM CST Cost: Free Please contact General Counsel, Dan Le [email protected] or Xiong Lee, Director of Engagement [email protected] with any questions. Join the CREW Young Professionals this year's CREW Summer Social, which will be hosted IN-PERSON, on Thursday, August 3rd from 4:00-8:00 p.m.

The CREW is excited to bring together credit union young professionals for an evening of socializing at Pinstripes. This event will include meeting with peers, learning credit union industry updates and hearing from our sponsors Affinity Plus Credit Union. This event comes at No Cost for attendees and includes bowling, food and a drink ticket. Space is limited. Registration ends July 27th! Agenda: 4:00 p.m. Registration 4:30 p.m. Social/Food/bowling 6:00 p.m. Network update/Affinity Plus CU Speech 6:30 p.m. Open Forum and more networking Time: 4:00 - 8:00 p.m. Location: Pinstripes 3849 Gallagher Dr Edina, MN 55435 Cost: FREE Trailblazer Executive Readiness Applications Closing this Friday; 2023 Participants Highlighted7/25/2023

MnCUN’s Trailblazers Executive Readiness Training program is a 12-month program is designed to accelerate executive level leadership skills and build credit union specific knowledge needed to succeed in our industry. Upon completion, participants will receive a Minnesota Credit Union Executive Leadership Certification. The cohort meets the second Thursday of the month for 12 months –virtually and in person – providing participants the opportunity to build a close network of colleagues. The program runs September - September. The deadline to apply for the 2023/2024 Cohort is Friday, July 28, 2023. For more information and to apply, visit Trailblazers Executive Readiness Training - Minnesota Credit Union Network (mncun.org). With questions, contact MnCUN Director of Engagement Xiong Lee or Vice President of Communications and Engagement Andrea Molnau. 2022-2023 Trailblazers Ahead of the graduation of this year's cohort of MnCUN’s Trailblazers Executive Readiness Training program in September, we will be highlighting the credit union professionals participating in the second year of the program. Lisa Jacobson, SPIRE Credit Union, Director of Digital Innovation & Strategy Why have you chosen a career in credit unions? People helping people is powerful and uplifting. Whether that means helping our members, community, internal service or networking with other credit unions. How do you think the Trailblazer program will impact your career? I found it very valuable to learn more about different business areas within the credit union that I don't have as much day to day exposure to. This will empower me to feel more knowledgeable and comfortable as I grow in my career. What have you enjoyed most about the program? Getting to know my fellow Trailblazers. Learning, growing and sharing together. Susan Shold, Members Cooperative Credit Union, Vice President of Human Resources Why have you chosen a career in credit unions? The credit union industry's values align perfectly with my own. Being not-for-profit and member-focused, means we care more about people than profits. I believe the work we do to help our members and communities improve their financial well-being is crucial, now and for future generations. How do you think the Trailblazer program will impact your career? I believe the Trailblazers program will have a significant impact on my career. The program has helped me develop essential leadership skills such as strategic thinking, decision-making, and communication. Also, learning alongside fellow credit union leaders has exposed me to new ideas, concepts, and perspectives. Having a broader perspective will help me approach challenges and opportunities from a more informed and strategic standpoint. It has also allowed me to build a strong network of individuals and industry experts who I can collaborate with now and into the future. What have you enjoyed most about the program? Building connections with fellow credit union leaders has been extremely valuable. I am confident the relationships that have been built will remain long after the program sessions have ended. Josh Villa, Magnifi Financial, VP of SBA Lending Why have you chosen a career in credit unions? Coming from banking, I have seen first hand the power that the collaboration in the credit union space brings to the industry. How do you think the Trailblazer program will impact your career? The program does a good job sharing different perspectives on issues that many credit unions face. The program itself gives good exposure to different concepts and also a network of other credit union professionals that can help support you as you grow. What have you enjoyed most about the program? Networking Patti Gagnon, TopLine Financial Credit Union, AVP Operations Why have you chosen a career in credit unions? I believe in People helping People. I spent years working on the bank side of the financial industry and see such a large difference between credit unions and banks. Putting our members and local communities first is much more important than just the bottom line. At TopLine I get to live and breathe that belief. How do you think the Trailblazer program will impact your career? The program has provided me an opportunity to experience different areas of business within my organization that I might not have had otherwise. What have you enjoyed most about the program? Meeting the other participants and developing connections and a network of support for the future. Minnesota has passed a paid sick and safe leave law. This is not to be confused with the MN Paid Family Medical Leave regulation which was also passed previously. Lockton Companies, which administers the Minnesota Credit Union Employee Benefits Plan, recently drafted an Alert to provide credit unions with important information regarding this new ruling, as well as various steps needed to comply with it. Here are some things to note about this legislation:

Login to download the full Alert. |

The PulseThe Pulse is MnCUN's newsletter that keeps credit union professionals and board members updated on current news and information. Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed