Confirm your Credit Union’s Participation in the 2023 Minnesota Consumer Consideration Initiative11/29/2022

2023 will mark Minnesota’s fifth year supporting the Credit Union Consumer Awareness Initiative. The program continues to evolve to bring credit unions additional value and ROI for their marketing investment, and more ways to engage with consumers. We listened to your feedback and are shifting from awareness & consideration to consideration & action - resulting in increased membership opportunities and market share. To continue this momentum, 2023 program updates include:

Check out the full list of benefits and match with the plan that works best for your credit union. In addition to the YMF Program Benefits, MN Credit Unions will benefit from additional deployment efforts, as a portion of their subscription will be used for statewide and local tactics. New annual pricing is now available. Thank you to Wings Financial Credit Union for generously sponsoring a Standard level subscription for all MnCUN member credit unions $100 million in assets and under. Select your subscription level by completing the 2023 Awareness Contribution Form. Please note registration and payments must be complete by January 27, 2023. With questions, visit mncun.org/awareness-campaign or contact MnCUN Vice President - Communications and Engagement Andrea Molnau. Learn more about the outstanding programs, new initiatives and well-deserved recognition received by your peers recently:

Got news of your own? Send stories, pitches, press releases and published articles to MnCUN Director of Communications Julia Miller. Support Grassroots Advocacy & Update Project Zip Code: Due to the 2022 mid-term election and redistricting, one-third of the next Minnesota Legislature will be new members.

Participate in the AACUL/CUNA interchange survey: Having updated data is critical as we lobby to protect credit union credit card interchange income. By Steve Heusuk, CUNA Mutual Group (this article is provided by MnCUN's partnership with CUNA Mutual Group. For more information, visit the Solutions Directory.)

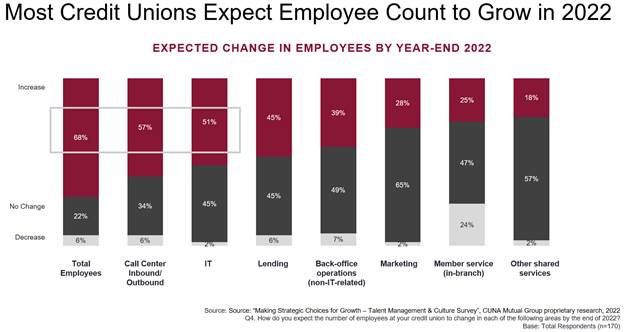

Credit unions and other employers are competing for talent in one of the tightest labor markets in U.S. history. While the labor market has cooled a bit, the Bureau of Labor Statistics recently reported that August job openings and the quit rate remained well above historical averages. Job openings, which peaked at 11.9 million in March, stood at 10.1 million in August - well above the historical average range of 5-6 million. The total non-farm quit rate stood at 2.7% in August, which was also much higher than its long-term average of 2.0%. With numbers like this, it’s no surprise that Cornerstone Advisors found the percentage of credit union executives who stated they are concerned about their ability to attract qualified talent rose from 19% in 2021 to 63% in 2022. To better understand how the current talent shortage is impacting credit unions, CUNA Mutual Group sponsored the “Making Strategic Choices for Growth: Talent Management and Culture” survey, which took place between June 15th – June 29th, 2022. A total of 170 credit union CEOs and human resources executives participated in this research. One of the most striking findings from this research is the large proportion of credit union executives expecting the total number of employees to increase despite the current talent shortage. Over two-thirds (68%) of study participants indicated they expect the total employee count at their credit union to increase by year-end 2022. Looking at these results by functional area, we see most credit union executives expect the number of call center and IT employees to increase and between one-quarter and one-half expect headcounts in lending, back-office operations, marketing and in-branch member service to increase (see Figure 1).

The Minnesota Credit Unions for Kids Committee invites all credit unions to participate in the 2023 Chain of Hearts fundraiser Jan. 2 to Feb. 28, 2023*. The initiative benefits Minnesota and western Wisconsin’s Children’s Miracle Network Hospital, Gillette Children’s. Gillette Children’s treats kids with disabilities and complex medical conditions in all Minnesota counties and beyond. During the fundraiser, credit union members and local businesses are encouraged to purchase paper links and hearts that are connected and hung in lobbies to help illustrate the "people helping people" philosophy of credit unions. All proceeds benefit Gillette Children's Hospital. To participate, credit unions simply fill out the registration form by Friday, December 16, 2022, and CU4Kids will provide Chain of Hearts materials at no cost. With questions, reach out to Director of Engagement, Ben Hering, via email or call at (612) 239-0026. *Although these are the campaign dates, credit unions may participate during any time frame that best fits their calendar. AmazonSmile is a simple and automatic way to support the Minnesota Credit Union Foundation every time you shop at Amazon, at no cost to you. When you shop at smile.amazon.com, you’ll find the exact same low prices, vast selection and convenient shopping experience as Amazon.com, with the added bonus that Amazon will donate a portion of the purchase price to the Minnesota Credit Union Foundation. You use the same account on Amazon.com and AmazonSmile. Simply visit smile.amazon.com and enter Minnesota Credit Union Foundation when selecting your charity.

The Minnesota Credit Union Foundation (MnCUF) provides grants, community partnerships, professional development and disaster relief to help the state's credit unions and communities prosper and thrive. Founded in 1969 by the Minnesota Credit Union Network, MnCUF is a 501(c)(3) charitable organization governed by a seven-member board of directors from various Minnesota credit unions.  The entire MnCUN staff would like to thank each member for supporting the credit union system. We truly value the important work you do every day for your members, which inspires us to advocate on your behalf to make that job easier. We are also humbled by the kind words we have recently received from several members about the value of being a member of the Minnesota Credit Union Network. “Crow Wing Power Credit Union belongs to the Network because of the many resources that are available to the members. We take advantage of the webinars offered, the P2P sessions and the various conferences. The Network is a great place to network with other Credit Union professionals, no pun intended!” Joan Wileman, President, Crow Wing Power Credit Union “We belong to MnCUN because there is strength in numbers. MnCUN leverages our collaborative spirit to advance our movement. It brings credit unions together as a powerful single voice for advocacy, ensuring legislative and regulatory challenges are widely understood and effectively addressed. MnCUN’s exceptional leadership is grounded in our industry’s DNA, emerging from the philosophy of helping people. When our credit union experienced executive turnover, MnCUN accelerated our ability to network with colleagues by creating invaluable opportunities to share ideas, challenges, and aspirations for making our world better.” Steve Ewers, President/CEO, Members Cooperative Credit Union “The Minnesota Credit Union Network is a tremendous resource for credit unions of all sizes. They work diligently at the state and federal level on legislation and regulatory issues that can impact credit union operations and growth opportunities. The staff is easy and enjoyable to work with and they are extremely dedicated to the success of Minnesota Credit Unions.” Kristi Mukomela, President & CEO, Novation Credit Union “Toro Credit Union belongs to the Minnesota Credit Union Network because of the value it delivers to our credit union. It is important to have our state trade association because we benefit from the political advocacy at a state and national level, the Awareness campaign, staff educational opportunities from the P2P sessions and conferences, and networking opportunities at the local, state, and national level which provide the best opportunities to learn best practices. MnCUN is special because they are a national leader and pioneer in their Credit Union Awareness program, very effective in advocacy at the state level, and a first-rate staff.” Grant Johnson, CEO, Toro Credit Union Thank you all for your continued support of MnCUN and the credit union system. Happy Thanksgiving! Last week, Governor Tim Walz re-appointed Grace Arnold to serve as the Commissioner of the Commerce Department. Commissioner Arnold must eventually be confirmed by the Minnesota Senate and MnCUN looks forward to continuing working with her and the Commerce Department.

Additionally, DFL Leadership in both the Minnesota House and Senate named Committee Chairs last week. MnCUN looks forward to working with Representative Zach Stephenson and Senator Matt Klein as Commerce Committee Chairs. Once session starts, MnCUN Members can view the bill tracking document on the Political Publications page of mncun.org. |

The PulseThe Pulse is MnCUN's newsletter that keeps credit union professionals and board members updated on current news and information. Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed