Minnesota’s Credit Unions Elect Board; Honor Colleagues at ACCELERATE 22 Annual Conference4/26/2022

Last week, over 400 credit union professionals, board members, and exhibitors from across Minnesota gathered for ACCELERATE 22, the Minnesota Credit Union Network’s annual conference.

Held at the Radisson Blu Mall of America in Bloomington, the conference featured guest speakers, educational sessions, networking opportunities, the MnCUN Business Meeting, the state’s largest credit union vendor exhibit hall, the Foundation Scholarship Council’s annual Silent Auction, and the annual CU4Kids Karaoke for Kids event. United States Senator Tina Smith addressed attendees affirming her support for credit unions and how credit unions provide affordable financial services and put members and communities first. Attendees also received public policy updates and more information about the strategic expansion of the national consumer awareness and consideration initiative. Kat Perkins, speaker and entertainer, closed the conference with an inspiring experience about finding your passion, taking leadership, working with others, and living fearlessly. During the annual business meeting, the election results were announced. Two incumbents were re-elected, and one new member, was elected to three-year terms on the MnCUN Board of Directors:

Following the Business Meeting, Board table officers were elected. Mary Hansen of Mayo Employees Federal CU will serve as Chair, Brian Sherrick, of Ideal Credit Union will serve as Vice Chair, and Dave Boden of Hiway CU will serve as Secretary/Treasurer. Minn. Credit Unions Honor Colleagues during Awards Breakfast The Minnesota Credit Union Network presented the Outstanding Credit Union Director of the Year and Outstanding Credit Union Professional of the Year awards at a ceremony during the conference. The Director of the Year Award is given to a credit union board member who best represents the credit union spirit through dedication to, and belief in, the credit union movement. The Outstanding Credit Union Director of the Year Award honor was awarded to Jim Kaster, outgoing Board Chair of TopLine Federal Credit Union. The Professional of the Year Award is given to a remarkable person who truly stands behind the “people helping people” credit union philosophy. This year, the Minnesota Credit Union Network’s honoree for Outstanding Credit Union Professional of the Year Award went to Dave Boden, President & CEO of Hiway Credit Union “The Outstanding Professional and Director of the Year is the Minnesota Credit Union Network’s most prestigious awards and its recipients have distinguished themselves in their efforts to better their credit unions and promote credit union movement,” Mark Cummins, President and CEO of the Minnesota Credit Union Network, the state’s trade association for credit unions. ACCELERATE 23 will be back at the Radisson Blu April 13-14, 2023  CUNA Mutual Group announces donation match of up to $250,000 to Village Financial. CUNA Mutual Group announces donation match of up to $250,000 to Village Financial. CUNA Mutual Group will be offering a donation match – dollar for dollar up to $250,000 – for individuals and credit unions who donate to the Village Financial Capital Drive through June 30, 2022. “CUNA Mutual Group believes brighter financial futures should be accessible to everyone. As a result we are proud to be able to provide this support, and hope this match opportunity encourages those who have not provided a donation to do so now,” said Susan Hochsprung, Vice President, Sales, of CUNA Mutual Group during the announcement. Debra Hurston, Executive Director of the Association for Black Economic Power (ABEP), the nonprofit organization created to establish a Black-led credit union in Minneapolis, continued, “Thank you all so much for all of your support – both financial and in kind. We are thrilled to be a part of the cooperative movement and are excited to see this initiative get another step closer to fruition.” The Minnesota Credit Union Foundation is seeking both Capital Contributions, Individual Contributions, and Pledges of Deposit to help support this effort. To learn more about making a financial commitment, visit mncun.org/villagefinancial or contact Minnesota Credit Union Foundation President Mark Cummins or Executive Director Andrea Molnau. Exciting Changes to Credit Union Awareness and YourMoneyFurther.com Announced at Accelerate 224/26/2022

Christopher Lorence, Executive Director of CU Awareness, joined Accelerate 22 to provide an update on exciting new enhancements to the national consumer consideration initiative.

YourMoneyFurther.com is LIVE! After over a year of research and development, CU Awareness just relaunched YourMoneyFurther.com! This consumer website not only serves as the destination for paid ads but also connects consumers with more content about the benefits of joining a credit union. Additionally, we highlight Participating credit unions encouraging consumers to "Join Now." Check out the website at YourMoneyFurther.com. Contributing credit unions received an outreach from CU Awareness directly to update their locator listing and to take advantage of the new benefits. New Customizable Organic Social Media Assets To match the aesthetic of the new website, a variety of new customizable campaign creative assets were just released that participating credit unions can use in their organic digital channels. These assets are available on Contributor HQ. National Program Update If you missed the update at Accelerate 22, CU Awareness will host a national program update on Monday, May 2nd at 1 pm EST. During this webinar, the Q1 2022 national program performance will be reviewed, program learnings and insights shared, and more information about the transition to the next stage of the program discussed. The ongoing investment Minnesota Credit Unions have made to boost consumer awareness is paying benefits in growth and knowledge of consumers across the state. Minnesota was the first state to launch the national Credit Union Consumer Awareness Initiative in 2019 and since then, has seen both increased average membership growth and consumer familiarity of credit unions. With questions, please contact Andrea Molnau, VP Communications & Engagement, by email or 651-288-5527. Join us for a virtual Data Governance Deep Dive workshop on Wednesday, June 15, facilitated by Anne Legg, Founder of THRIVE Strategic Services.

The mission of a data governance program is to give a formal structure to its data. Its primary focus is on the management of data access, quality, and security throughout its life cycle. It has been called a “must-have” by consulting firm McKinsey for enterprise data success. A formal data governance program is already appearing on many regulatory audits and will likely be a mandatory feature of a data program assessment in the next year. The challenge for many credit unions lies in the creation of a launch plan and having a template for success. This 3-hour webinar will fill these knowledge gaps by providing the following: 1) a basic foundation to data governance, 2) a framework for success 3) a detailed launch road map. Deliverables:

Date: June 15 Time: 8:30-11:30 a.m. CT Location: Webinar Cost: $595 This event will only be made available via webinar. The instructor: Anne Legg is an award-winning industry expert, author, educator, member-centric data strategist who holds an MBA thesis on the credit union business model. With questions, please contact MnCUN Director of Engagement Ben Hering by email or by phone at 651-288-5519. Peer-to-Peer sessions (P2P) provide credit union professionals the opportunity to participate in cooperative meetings to network and exchange ideas. To receive notifications specific to your job area, please update your preferences in the Member Portal.

Webinar and call in instructions, along with recordings, session materials and resources, will be provided to registered attendees. Register and join the discussion! Board Directors P2P Thursday, May 5 starting at 4:00 p.m. via webinar and video conference. Register Accounting & Finance P2P Tuesday, May 10 starting at 1:00 p.m. via webinar and video conference. Register Credit Union Foundation P2P Tuesday, May 17 starting at 1:00 p.m. via webinar and video conference. Register Innovation P2P Thursday, May 19 starting at 1:00 p.m. via webinar and video conference. The first Innovation P2P of the year will begin with a panel of experts who are leading innovative initiatives and projects in their credit unions. Our panel will include:

CREW Young Professionals P2P Thursday, June 2 at 1 p.m. via webinar and video conference. The first CREW Young Professionals P2P of the year will be focused on credit union advocacy. The session will include a presentation on legislative initiatives, a panel of credit union leaders and breakout groups discussing what young and emerging leaders can do to support the credit union movement. Register Marketing & Business Development P2P Tuesday, June 14 starting at 1:00 p.m. via webinar and video conference. Register Stay tuned for further announcements and updates! For a list of all P2P sessions, visit our Peer-to-Peer (P2P) webpage. With questions, please contact MnCUN Director of Engagement Ben Hering by email or by phone at 651-288-5519. Minn. Credit Union Network Awards Bonus WINcentive Savings Prizes for Financial Well-being Month4/26/2022

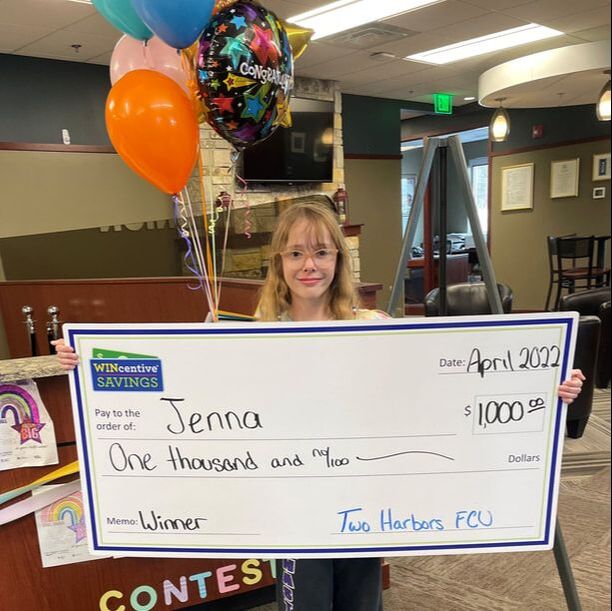

In celebration of Financial Well-being Month, the WINcentive Savings Program awarded six additional prizes as part of its quarterly drawing. The Minnesota statewide prize pool for the quarter included five $1,000 quarterly prizes, and 50 $100 monthly prizes, and an additional six $1,000 prizes to celebrate the month’s initiative. 11 credit union members from Affinity Plus Federal Credit Union, First Alliance Credit Union, Hiway Credit Union, Mid Minnesota Federal Credit Union, North Star Credit Union, Two Harbors Federal Credit Union, and West Metro Schools Credit Union were among the winners of the programs April prize drawing.

The final keynote speakers for Co-op Solutions' THINK 22 have been revealed: Colin Bryar, a former top-level executive at Amazon and best-selling author of “Working Backward,” and Fred Reichheld, who leads the loyalty practice at Bain and is the inventor of the Net Promoter system. They join an already-impressive lineup of speakers and changemakers from inside—and outside—the credit union industry who are scheduled to appear at the credit union industry’s premier growth strategy conference.

Join Co-op Solutions in person May 2-6 in Chicago or register today for the virtual experience offering select general session content and special offerings from wherever you are. Either way, you’ll have access to new research showing the importance of knowing members like never before and actionable insights to help you put members front and center, future proofing your model to keep pace with increasing member expectations. Join the Minnesota Credit Unions for Kids Committee for the 27th Annual Credit Unions for Kids Golf Tournament on Thursday, June 16, 2022 at the Refuge Golf Club in Oak Grove. Registration for the tournament closes on Friday, June 10 -- reserve your spot today!

The Minnesota CU4Kids Golf Tournament, founded in 1995, supports Children’s Miracle Network Hospitals/Gillette Children’s Specialty Healthcare in St. Paul. Over the years the event has raised over a half-million dollars for the credit union-sponsored cause. Thursday, June 16, 2022 Refuge Golf Club | Oak Grove, Minn. 11:00am – Registration/Box Lunch 12:00pm – Shotgun Start 4:30pm – Social Half-Hour 5:00pm – Awards Dinner Please see the event flyer for further details and to register. With questions, reach out to Marty Kelly via email. Last week, members of the Minnesota Credit Unions for Kids Committee (CU4Kids) and the Foundation Scholarship Council (FSC) received awards for outstanding service at the ACCELERATE 22 conference at the Radisson Blu Mall of America in Bloomington.

The Minnesota chapter of Credit Unions for Kids raises funds for Gillette Children’s Specialty Healthcare, a Children’s Miracle Network hospital. Minnesota CU4Kids has raised over $3 million for Children’s Miracle Network Hospitals since 1997. Caitlin Brama of Financial One Credit Union received the award for Minnesota CU4Kids Outstanding Volunteer. Caitlin has served on the committee since 2018 and was elected as co-chair of the CU4Kids committee in 2020, a position which she holds now. The FSC strives to build credit union brand awareness and strengthen member relationships through its scholarship program. The FSC annual scholarship program is made possible through its annual silent auction. Joann Ericksen of Minnesota Valley Federal Credit Union was named FSC Volunteer of the Year. Joann has served on the Foundation Scholarship Council committee since 2018 and has played a critical role in the success of FSC efforts throughout the pandemic. “Both the Foundation Scholarship Council and Minnesota Credit Unions for Kids represent the credit union philosophies of cooperation and people helping people,” said Minnesota Credit Union Foundation Executive Director Andrea Molnau. “Caitlin and Joann have gone above and beyond by devoting their time and talent to ensuring their respective committees exceed their goals. On behalf of the Minnesota Credit Union Foundation, I would like to thank and congratulate both women.” Dana Garrett, former Chair of the Minnesota Credit Union Foundation, was presented a Proclamation of Appreciation along with a Gavel Award in recognition of her time as chair and the leadership she provided the Foundation during the ceremony. "The Minnesota Credit Union Foundation Board of Directors thanks Dana Garrett for her time and leadership as chair for the last two years and for her service to the board for the last 5 years," said Mark Cummins, President of the Minnesota Credit Union Foundation. For more information the Minnesota Credit Union Foundation, the CU4Kids Committee and FSC, visit the Foundation section of the MnCUN website. |

The PulseThe Pulse is MnCUN's newsletter that keeps credit union professionals and board members updated on current news and information. Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed