Report Highlights Benefits of Prize-linked Savings, Quarterly WINcentive® Winners Celebrated7/22/2020

The Minnesota Credit Union Network is excited to announce the findings of a report published by Commonwealth, highlighting the benefits members of credit unions have experienced through prize-linked savings accounts. The report, conducted with participating members of the WINcentive program, shows that offering the chance to win a prize is effective in promoting savings habits, and also may attract members to their first committed savings product. The full report can be viewed on Commonwealth’s website. With the second half of 2020 in full swing, the Minnesota Credit Union Network has filled out the calendar for the remainder of the summer and through the fall with Peer-to-Peer (P2P) sessions.

In March, spring P2P sessions were transitioned to a virtual format, utilizing webinar and video conferencing to continue bringing credit unions together for conversations around timely topics. Reflecting on the year thus far and looking toward an increasingly uncertain future, the remainder of the P2P sessions will be held as virtual sessions and will continue to provide open forums that foster conversations conducive to credit union collaboration in an rapidly evolving time. Below is the list of each scheduled or anticipated P2P session. Follow the links to learn more and register and for further announcements and updates, visit our Peer-to-Peer (P2P) web page at: https://www.mncun.org/peer-to-peer.html Summer and Fall 2020 P2P Sessions: 08/18 Collections P2P 8/20 Financial Education P2P 08/25 BSA Officer and Compliance P2P 09/16 Accounting & Finance P2P 09/23 Business Services & Commercial Lending P2P 9/24 Marketing and Business Development 10/06 Call Center P2P 10/15 Branch Operations P2P 10/20 Training & Development P2P 10/27 Data & Analytics P2P 11/04 Crew Young Professionals P2P TBA Innovation P2P With questions, please contact MnCUN Director of Engagement Ben Hering by email or by phone at 651-288-5519. The Network’s Board of Directors represent the interests of credit unions of all sizes and from all parts of the state. The Board works together with MnCUN’s President & CEO to ensure that all member credit unions receive high-quality service and that the interests of Minnesota credit unions are promoted both at the state and national level.

The Network Board met last week, both virtually and in-person, to discuss MnCUN’s Diversity, Equity, and Financial Inclusion Strategy, hear reports on updated financials, and get updates on legislative, political and awareness initiatives. Additionally, the Board recognized outgoing Board Member Terri Maloney on her retirement from Catholic United Financial Credit Union. The Network thanks Terry honored her for her service. The Board will appoint an interim Board Member to serve until the next Annual Business Meeting will be named by the Board at its next meeting. MnCUN’s Political Involvement Committee Recommends State Charter Working Group to Become Official Sub-Committee

Last week, the Network’s Political Involvement Committee (PIC) met to discuss the Network’s 2020 election activities, as well as adopt a recommendation that the heretofore ad hoc State Charter Working Group be made an official committee under PIC. MnCUN will facilitate an open discussion with CEO’s and HR professionals on upcoming HR challenges in 2020. The State of Minnesota is expected to provide guidance by July 27th on school operations.

This will be an opportunity to hear from others and share what your credit union is looking at for staffing challenges in the Fall of 2020. Meeting login instructions will be provided to registered attendees prior to the session. This will be an open format presentation and discussion. Questions will be addressed and audio lines will be open for this meeting. Thursday, July 30 9:00 - 10:00 a.m. Registration With questions, please reach out to Chief Advocacy & Engagement Officer, Mara Humphrey, via email or by phone at (651) 288-5523 Bureau Announces Regulation Z Threshold Adjustments

The Bureau of Consumer Financial Protection (Bureau) is required to calculate annually the dollar amounts for several Regulation Z thresholds. Recording of Webinar on Updates to Minnesota’s Laws Protecting Vulnerable Adults Available The recording of the webinar on Updates to Minnesota’s Laws Protecting Vulnerable Adults – Impact on Credit Unions is now available on MnCUN’s website (Login required). Unemployment Benefits Fraud Continues to be a Problem Many Minnesota credit unions continue to be targeted by a large-scale scam involving fraudulent unemployment benefits claims. The Minnesota Credit Union Network put out a fraud alert on this issue in late May. Quick insights from CU Rise:

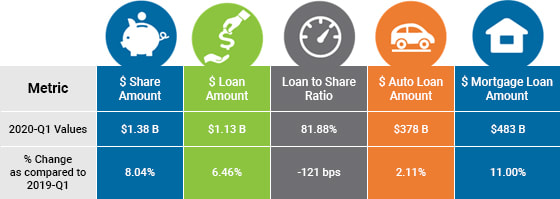

It is time to visit CUCompare.com and get updated insights about your credit union and your peer’s performance. You can benchmark and track performance through a variety of defined and customizable metrics. CUCompare also has the functionality to perform national, state & asset-band comparisons with peers and much more to help you know where you stand and where you are headed. Sign up or log in to get free access to the tool and to receive your CU's benchmarking report.

Watch MnCUN Director of Business Development, Kris Jacobsen, share how Netgiver‘s donation platform provides credit unions support for their community advocacy efforts and creates opportunities for member acquisition and retention.

Earlier this year, MnCUN joined the ownership by joining the ownership of NetGiver; a CUSO which enables fee-free charitable contributions exclusively for credit union members through a mobile giving platform. For more information on this partnership, contact Kris Jacobsen. The Minnesota Credit Union Foundation held its Annual Meeting on July 16, 2020.

Board Chair Kathy Harrington, of Heartland Credit Union, reported on the efforts of the Foundation in 2019. Over $53,000 was distributed in support of various grant programs – which is a $20,000 increase over the prior year – mainly in the areas of professional development opportunities for credit union staff across the state. In addition:

The Board Election was held. Doug Hallstrom of Minnco Credit Union was re-elected to fill a second 3 year term. He currently serves in the position of Secretary/Treasurer. Tom Smith, of TopLine Federal Credit Union was elected to his first 3 year term. Smith is currently serving on the Network Board of Directors and will replace Mary Hansen’s seat. Mary Hansen of Mayo Employees Federal Credit Union has termed off the Foundation Board. She was recognized at the meeting for 14 years of dedicated service to the Minnesota Credit Union Foundation. As a 501(c)(3) tax-exempt charitable organization, the Foundation is dependent on the support of Minnesota credit unions, employees, partners, and community organizations. Visit mncun.org/foundation for a copy of the 2019 Annual Report. |

The PulseThe Pulse is MnCUN's newsletter that keeps credit union professionals and board members updated on current news and information. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed