|

The deadline to submit projects for the annual Dora Maxwell, Louise Herring and Desjardins Financial Education recognition programs is this Friday, June 24. Submitted projects should have primarily taken place during 2021.

Links to the individual award applications are below. Those who enter will compete with other credit unions in the same asset category.

Award entries are judged by the Dakotas Credit Union Association Awards Committee to ensure unbiased results. The winners in each award category will advance to CUNA’s national contest where they will compete with credit unions across the country, with judging to take place this fall. Full program details and FAQs are available on the MnCUN Awards Page. Contact Julia Miller, MnCUN Director of Communications with questions by email at jmiller@mncun.org.

A Simple Plan For Success

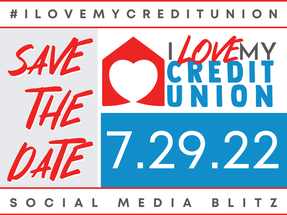

Remember, it’s all about inspiring credit union teams and members to share what’s best about their CU experience on all social media platforms. We’re counting on you to make this year’s campaign an even bigger victory for credit unions! If you have any questions about ways your credit union can participate, contact ilovemycreditunion@icul.com

By Opal Tomashevska, Director, Multicultural Business Strategy, CUNA Mutual Group. This article is provided as part of MnCUN's partnership with CUNA Mutual Group.

As I talk with credit unions around the country, I’ve been able to engage with many in the movement around multicultural business strategy, and there is one message I repeat over and over. To be competitive and to live up to our founding principle of people helping people, multicultural business strategy isn’t optional. It’s essential. While multicultural business strategy is gaining traction in our industry, there are still some who believe that for their community or their credit union, it doesn’t apply. But that thinking doesn’t match our reality. Take a look at the evidence:

Focusing on multicultural consumers is not a nice to have or an add on. If you are going to stay competitive and not fall behind, it’s an essential part of your core business strategy. The same multicultural business strategies that enhance empowering relationships with members when focusing on race, age, ethnicity, and culture, extend to your ability to better serve members along all aspects of diversity including gender identity, sexual orientation, physical and mental ability, and socioeconomic status.

One of the easiest ways contributing credit unions can connect their marketing efforts to the Your Money Further™ program is by using the social media packs. These assets are available on Contributor HQ for all participants to use in their organic social media channels and include options to co-brand graphics and videos. If you need assistance accessing the Contributor Headquarters please reach out to Andrea Molnau, VP Communications & Engagement.

The ongoing investment Minnesota Credit Unions have made to boost consumer awareness is paying benefits in growth and knowledge of consumers across the state. Minnesota was the first state to launch the national Credit Union Consumer Awareness Initiative in 2019 and since then, has seen both increased average membership growth and consumer familiarity of credit unions. More information is available on MnCUN’s Awareness page. Is your credit union looking to leverage Multicultural Opportunities in your market? Please join us for a series of webinars that connect the MnCUN Multicultural Opportunity Report with actionable examples for your credit union and your communities to grow and prosper. Presented by Coopera, a full-service multicultural analytics and consulting firm, the series continues on June 22nd; and August 10th. All sessions will be held from 1 to 2 p.m. Further descriptions of each session are noted below. Follow this link to register.

June 22: Opportunities for Credit Unions to Serve Growing Multicultural Populations in MN This session will provide a further “deep dive” into the financial needs of Mexicans, Hmong, and African Americans – which are the largest growing ethnic groups in Minnesota. We’ll share practical examples of how credit unions can meet those needs via products, community outreach, staff, and more. This is session is particularly useful for credit unions looking to enhance outreach and services for Minnesota’s immigrant/refugee and African-American communities. August 10: How can we do better? Addressing and closing the Wealth Gaps in Minnesota Our final session will focus on the current wealth gaps in Minnesota. We’ll take a closer look at our own bias around lending, branding, and risk; and explore practical ways to overcome those biases to improve financial wellbeing for all. CUNA's Project Zip Code is a powerful advocacy tools that allows the Minnesota Credit Union Network to share with individual legislators how many credit union members are in their districts.

The Tristate Mentor Match is a 12-month program designed to build, grow, support, and inspire credit union professionals in their careers and commitment to the Credit Union Movement. It envisions relationships based upon commitment, common goals and expectations, and mutual trust and respect, in which both the mentee and mentor grow in the process.

This program is a partnership among the Minnesota Credit Union Network, Montana’s Credit Unions and the Wisconsin Credit Union League to expand our reach and bring our collective members a rich and diverse opportunity to network and grow. “I think this mentorship program was one of the best ideas and collaborations I have ever been a part of! My mentor has been FANTASTIC and I am still trying to figure out how the team was able to match us so perfectly. She has been vital to my recent successes and helped me find more confidence within my role, my development, and myself. I highly recommend this program!” Caitlin Brama, Branch Manager, Financial One Credit Union. Applications are now open for both mentees and mentors. Deadline to apply is August 5, 2022, and the program kicks off in September. More information is available on our online mentorship page. |

The PulseThe Pulse is MnCUN's newsletter that keeps credit union professionals and board members updated on current news and information. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed