|

Join the upcoming Data & Analytics Peer-to-Peer (P2P) on Tuesday, August 30 starting at 1:00 p.m. via webinar and video conference.

P2P sessions will continue to be held as virtual roundtables, providing open forums for credit union staff throughout Minnesota, for knowledge sharing, resources and connections. This event will be made available only via webinar/conference call. Webinar and call in instructions, along with recordings, session materials and resources, will be provided to registered attendees. Stay tuned for further announcements and updates! For a list of all P2P sessions, visit our Peer-to-Peer (P2P) webpage. With questions, please contact MnCUN Director of Engagement Ben Hering by email or by phone at 651-288-5519. Steve Danco, SVP, Direct to Consumer Experience, CUNA Mutual Group

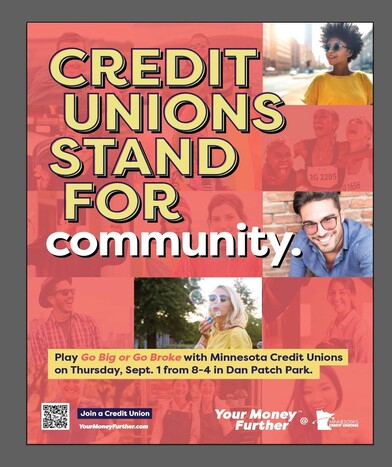

This article is provided by MnCUN's Partnership with CUNA Mutual Group. Contact MnCUN Chief Operating Officer, John Ferstl for more information. Credit unions have long nurtured a deep trust with members. Historically, that trust has been difficult for even the most formidable opponent to duplicate. Difficult, yet not impossible. In fact, research shows that the investments big banks have made in technology have leveled the playing field in the battle for the trust and loyalty of financial consumers. They have been able to change the game by delivering simple, easy experiences that meet the needs of today’s consumers. Between 2020 and 2021, the share of consumers satisfied with their credit union fell almost two full percentage points, from 88.4% to 86.5%. At the same time, consumers satisfied with their digital and online banks rose two points, from 82.8% to 84.8%. In the race for satisfaction, credit unions and their competitors are neck-and-neck.* So, how can credit unions up their game and take an aggressive stance in the contest for trust and become their members’ most valued financial partner? In our work at CUNA Mutual Group, we see four distinct opportunities.  Once again, as part of the Awareness and Consideration campaign, Minnesota Credit Unions will have a presence at the State Fair. Our results over the years have shown strong presence and visibility at the Fair builds a strong engagement in the final part of the calendar year for the overall campaign. This year at the Great Minnesota Get Together, we will share the credit union difference in a fun and engaging way that focuses on financial education. This is a unique opportunity to have a collaborative, in-person presence at the fair with options for earned media to take advantage of the broad audience the State Fair attracts. Minnesota Credit Unions will host a live Go Big or Go Broke game at the UCare Day-Long Event in Dan Patch Park on September 1st, supported by a 12-day feature with iHeart media. The game has been donated and offered in partnership by Royal Credit Union. In addition, we will support the event with mobile and out of home ads throughout the State Fair. Credit Union Awareness Fund Contributors can participate in the event by providing staff volunteers and/or branded swag for prizes. With questions about these opportunities, please reach out to Andrea Molnau or Julia Miller. We are looking forward to highlighting Minnesota Credit Unions at the Fair!  We are happy to announce Mallory Weggemann will now join us at LEAD 22 due to a cancelation of a previously scheduled speaker. Fresh from the 2020 Tokyo Paralympic Games, where she won 2 gold medals and a silver medal, Mallory Weggemann is passionate about sharing how to persevere in the face of adversity, overcome impossible obstacles, and redefine limits. After an injury that led to permanent paralysis at the age of 18, Weggemann created a new life for herself. Within three-months of the injury, she found herself doing what she loved—swimming competitively—while chasing her dreams. In her keynote Small Steps, Big Impact: A “Small Victories” Approach to Leadership, Weggemann will share how to manage setbacks—especially those that come out of nowhere. Weggemann argues that we all have a choice: to allow limitations to overpower us, or face them in a journey toward new abilities and accomplishments. Focusing on mental fortitude and strength as the foundation for achieving personal greatness, along with defining boundaries, and reaching for individual goals and outcomes, Weggemann’s message offers takeaways for teams and individuals at all points in life’s journey. This session is hosted by the Minnesota Credit Union Women’s Leadership Network. With educational sessions and recreation activities, this event provides an opportunity to come together with your credit union colleagues for learning, networking, and fun – all the while keeping your health and safety in mind. More information, schedules, lodging information and registration links are available online at mncun.org/lead22. The Association of Black Economic Power held a townhall meeting last week to provide updates to the community on the new credit union and to announce the results of voting for the new name. The community voted for “Arise Community Credit Union” by a landslide. The new name will be used in place of Village Financial Credit Union going forward.

Also last week, CUInsight published an article by Nation Credit Union Foundation executive director Gigi Hyland and MN CU Foundation Executive Director Andrea Molnau on the importance of the creation of the credit union and its opportunity to truly impact Financial Well-being with cooperative values. The Minnesota Credit Union Foundation is seeking both Capital Contributions, Individual Donations, and Pledges of Deposit to help support this effort. To learn more, visit mncun.org/villagefinancial or contact Minnesota Credit Union Foundation President Mark Cummins or Executive Director Andrea Molnau.  Tim Tacheny, General Counsel for the Minnesota Credit Union Network is leaving his position on Aug. 18 after 5 years of service. We are excited for his next endeavor and thank him for his contributions to the Minnesota credit movement! Earlier this year, Tim received Excellence in HR & Organizational Development Award in the Management Practices category for his role in developing the Minnesota Credit Union Employee Benefits Plan. The Minnesota Credit Union Network is accepting applications for the General Counsel position. Interested applicants can apply at the Minnesota Credit Unions Jobs Board. Ahead of the graduation of the first cohort of MnCUN’s Trailblazers Executive Readiness Training program in September, we will be highlighting the credit union professionals participating in the inaugural year of the program.  Nicholas Mathiowetz, President/CEO, NorthRidge Community Credit Union Why have you chosen a career in credit unions? I choose to make a career with the credit union because of the impact that we, as a movement, can make on our members and communities. The cooperative structure can provide support for people, we can make dreams come true, change lives and help people live to their fullest potential. I couldn't ask for a better cause to dedicate myself to. How do you think the Trailblazer program will impact your career? This program has given a nice review of credit union operations. It was quite beneficial to see how other organization operate within the same constraints. I was also interesting to hearing the differences between credit unions at varying asset sizes. While our challenges are often the same, they are certainly tackled differently. These insights have allowed me to look at our operations with a new perspective and that has assisted some creative problem solving. What have you enjoyed most about the program? This program has provided a great resource to revisit some of things I've already done, and to give new ideas to handle those same things. It's also been a great place to connect with others in the industry and learn more from them. This Trailblazer's group is a fantastic group filled with incredibly talented and motivated people. Listening to them inspires me to learn and do more.  Jodi Maus, Training and Development Manager, Magnifi Financial Credit Union Why have you chosen a career in credit unions? I think the credit union industry is very unique. Staff are able to provide financing to members to help make their dreams come true. As an organization, we support the community through community involvement and donations. Our profits are reinvested to help members and the community. As staff, we are supported to grow and develop, personally and professionally. In the credit union industry, staff collaborate with other credit unions to share ideas to move credit unions into the future and continue to grow. It is truly a great industry to be part of! How do you think the Trailblazer program will impact your career? The Trailblazer program provided an overview of all areas of the credit union, from leadership, financial, branch operations and strategy. It was a great opportunity to learn about other areas of the business and gain ideas from other credit unions and industry leaders. The network and relationships built with other credit union leaders was the most valuable piece. The trust and collaboration will continue into the future. What have you enjoyed most about the program? I enjoyed the content and perspectives provided. However, the opportunity to build relationships with other credit union leaders was the most valuable piece of the program. There are many talented professionals in the Trailblazers and I am honored to be part of the cohort.  Denise Meinert, VP of Member Service & Marketing, South Metro Federal CU Why have you chosen a career in credit unions? It's an industry where professionals can come together to provide a service to members because they want to make a difference. They improve members lives by providing exceptional service and products and focus on improving members lives beyond their financial wellbeing by being involved in the local community. It's a unique industry and I feel fortunate to have a career helping others and working alongside other professionals with similar values. How do you think the Trailblazer program will impact your career? The practical hands-on approach of the program enables me to apply the knowledge firsthand and develop into a more skilled leader. It offered the opportunity to learn more in depth about areas of the credit union that I don't work directly with and provided me with a stronger understanding of all aspects of a credit union. What have you enjoyed most about the program? I've enjoy being able to collaborate with the cohorts and gain knowledge from their professional experiences in the Credit Union industry. Coming together as a community of professionals to learn to be better leaders has been invaluable and I look forward to continuing to network with each of them.  Brianne Meszaros, VP of Branch Operations, Hiway Credit Union Why have you chosen a career in credit unions? As a lifelong credit union member, and a credit union employee pretty much since high school, I have become fully immersed in the credit union movement and it feels like a natural fit with my values and beliefs. Making a difference in member's lives by acting in their best interest, providing financial education to better their future, and contributing to our local communities is fulfilling a greater purpose. How do you think the Trailblazer program will impact your career? I believe the Trailblazer program is a launch pad to the next level of credit union leadership. It has armed me with more in depth exposure and experience on key focus areas, enhancing my leadership skills, providing a solid foundation of credit union financials and operations, and giving me insight into successful strategic planning efforts. I am grateful for the network of peers that I have access to and can build future relationships with! What have you enjoyed most about the program? The most enjoyable part of the Trailblazer Executive Readiness Program is the camaraderie, collaboration and connections made amongst a group of high energy, highly driven, motivated individuals within the industry. The content was well rounded and provided a deeper dive into the important topics of leading and running a credit union. The Tristate Mentor Match is a 12-month program designed to build, grow, support, and inspire credit union professionals in their careers and commitment to the Credit Union Movement. It envisions relationships based upon commitment, common goals and expectations, and mutual trust and respect, in which both the mentee and mentor grow in the process. This program is a partnership among the Minnesota Credit Union Network, Montana’s Credit Unions and the Wisconsin Credit Union League to expand our reach and bring our collective members a rich and diverse opportunity to network and grow.

See what this year’s participants are saying about the experience: “I think this mentorship program was one of the best ideas and collaborations I have ever been a part of! My mentor has been FANTASTIC and I am still trying to figure out how the team was able to match us so perfectly. She has been vital to my recent successes and helped me find more confidence within my role, my development, and myself. I highly recommend this program!” Caitlin Brama, Branch Manager Financial One Credit Union This was my first experience mentoring an individual in a structural format. I felt like my own leadership skills increased as a mentor - it was like a two-way street. I gained new perspectives each time we connected, and I can honestly say this experience has changed the way I look at myself as a leader. I feel like I became more motivated in my own role. My mentee grew in her role and was promoted in the process! Serving as mentor is an opportunity to gain satisfaction giving back to your work community, and provides yourself a deeper appreciation and pride in what you do. I wholeheartedly recommend this experience! Kathy Harrington, President Heartland Credit Union "Being a mentor as part of the Tristate Mentorship Match program has been rewarding beyond words. Being part of another individual’s credit union’s journey is such a privilege. During the time I spent with my mentee, I have learned more about myself and my leadership style. I believe we both have grown and now have a strong bond with another credit union professional. The time commitment and agenda were driven by my mentee. She was excited to learn and so appreciative of the time we spent together. The 12-month commitment really is a lifelong connection. I am excited to see how my mentee will make an impact in the future!" Anita Quaglia, CUDE, VP of Member Engagement Minnco Credit Union Applications are open for both mentees and mentors. Deadline to apply is August 5, 2022, and the program kicks off in September. More information and a link to application are available on the online mentorship page. With questions, reach out to Mara Humphrey or Andrea Molnau.  This year's CREW Summer Social will be hosted IN-PERSON on Wednesday, August 17 from 4:00-8:00 p.m. Registration is open through Wednesday, August 10. The CREW is excited to bring together credit union young professionals for an evening of socializing at The Boat Club Restaurant at Fitger's Inn in Duluth. This event will include meeting with peers, getting credit union industry updates and a speed networking activity with credit union executives. Credit union executives from across Minnesota will be joining us for a speed networking activity. The guest leaders joining us are:

This event comes at no cost for attendees and includes dinner. Space is limited! Agenda: 4:00 p.m. Social Hour 5:00 p.m. Dinner starts 5:30 p.m. Network Updates 6:00 p.m. Speed Networking with Executives 7:00 p.m. Open Forum and Networking! With questions, please contact MnCUN Director of Engagement Ben Hering by email. |

The PulseThe Pulse is MnCUN's newsletter that keeps credit union professionals and board members updated on current news and information. Archives

May 2024

Categories

All

|

RSS Feed

RSS Feed