|

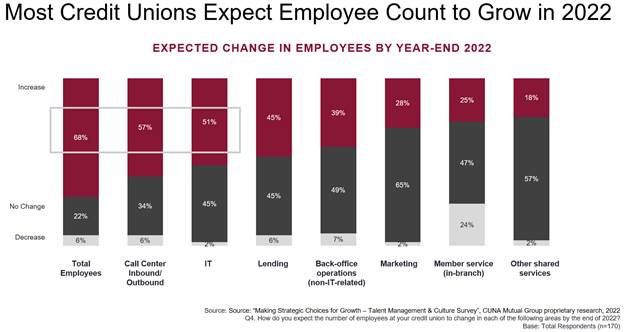

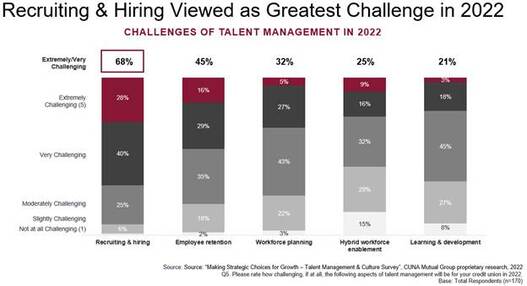

By Steve Heusuk, CUNA Mutual Group (this article is provided by MnCUN's partnership with CUNA Mutual Group. For more information, visit the Solutions Directory.) Credit unions and other employers are competing for talent in one of the tightest labor markets in U.S. history. While the labor market has cooled a bit, the Bureau of Labor Statistics recently reported that August job openings and the quit rate remained well above historical averages. Job openings, which peaked at 11.9 million in March, stood at 10.1 million in August - well above the historical average range of 5-6 million. The total non-farm quit rate stood at 2.7% in August, which was also much higher than its long-term average of 2.0%. With numbers like this, it’s no surprise that Cornerstone Advisors found the percentage of credit union executives who stated they are concerned about their ability to attract qualified talent rose from 19% in 2021 to 63% in 2022. To better understand how the current talent shortage is impacting credit unions, CUNA Mutual Group sponsored the “Making Strategic Choices for Growth: Talent Management and Culture” survey, which took place between June 15th – June 29th, 2022. A total of 170 credit union CEOs and human resources executives participated in this research. One of the most striking findings from this research is the large proportion of credit union executives expecting the total number of employees to increase despite the current talent shortage. Over two-thirds (68%) of study participants indicated they expect the total employee count at their credit union to increase by year-end 2022. Looking at these results by functional area, we see most credit union executives expect the number of call center and IT employees to increase and between one-quarter and one-half expect headcounts in lending, back-office operations, marketing and in-branch member service to increase (see Figure 1). Given that most credit union executives are expecting total headcount to increase in 2022, it’s not surprising that most find recruiting and hiring to be the most challenging aspect of talent management. Coincidentally, 68% of credit union executives indicated that recruiting and hiring talent will be very or extremely challenging in 2022. Retention was expected to be very or extremely challenging by 45% of study participants (see Figure 2). Credit unions are planning to undertake a variety of actions to meet these recruiting and employee retention challenges. A majority of study participants indicate their credit union would be taking the following actions to attract talent in 2022:

To retain talent, more than one-half of study respondents say they will:

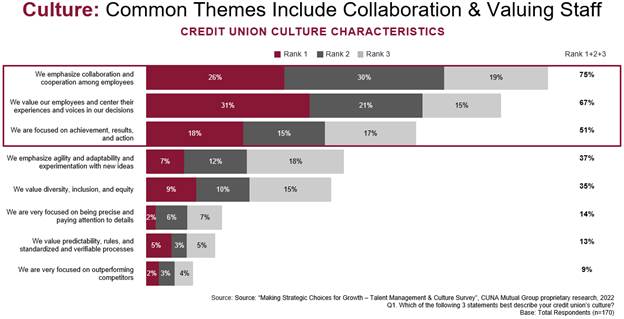

Given most credit unions are planning to highlight their culture when recruiting talent, what are the most common themes that describe credit unions’ culture? Three-in-four (75%) credit union executives surveyed ranked “We emphasize collaboration and cooperation among employees” as one of the top three statements that best describe their credit unions’ culture (see Figure 3). Two-thirds (67%) of respondents ranked “We value our employees and center their experiences and voices in our decisions” a top-three statement. Over one-half (51%) ranked “We are focused on achievement, results, and action” in the top three. This last statement was much more likely to be cited as a top three statement by respondents from the top one-third of credit unions in terms of 2021 ROA and 2019-21 loan growth, i.e., top-performing credit unions are more likely to embrace a culture emphasizing achievement, results and action. To succeed in attracting and retaining talent, credit unions should try to maximize their employee value proposition (EVP). EVP describes the unique experiences employees receive in return for the skills, capabilities and contributions they bring to the credit union. Your EVP is the reason why somebody would want to work at your credit union versus looking elsewhere. Once you acquire the talent – you then need to make sure you deliver on your “promises. According to Gartner, companies that effectively deliver on their EVP can decrease their annual employee turnover by nearly 70%.

Your current employees can be an important ally in the quest for new talent. Per Inna Conner, Senior Manager of Talent Management at CUNA Mutual Group, “It’s important to engage your existing employees in helping you define and design a compelling EVP. This alignment is essential because your current employees can be your most powerful advocates in the marketplace and play a key role in helping to attract talent.” Steve Heusuk is senior manager of customer intelligence for CUNA Mutual Group. Contact him at 608. 665.7854, or at [email protected]. Comments are closed.

|

The PulseThe Pulse is MnCUN's newsletter that keeps credit union professionals and board members updated on current news and information. Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed